I. Market Landscape: 8.6-Gen Lines Become the New Battleground for IT OLED

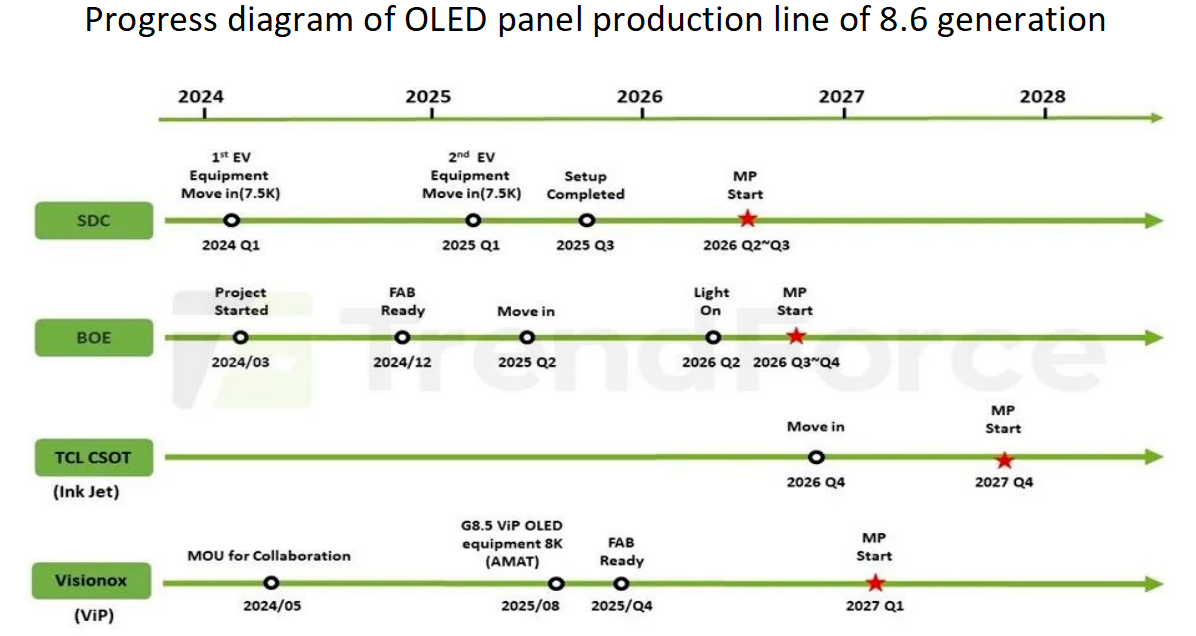

The global IT OLED panel market is witnessing fierce competition centered on 8.6-gen lines (2290×2620mm substrates), forming two major technology camps:

| Camp | Representative Manufacturers | Technology Route | Mass Production Timeline |

|---|---|---|---|

| FMM Camp | Samsung Display (SDC), BOE | Fine Metal Mask + Tandem OLED | Q1-Q2 2026 |

| FMM-free Camp | Visionox Technology, TCL Huaxing | Mask-Free Technology (ViP/IJP) | Q1-Q4 2027 |

II. FMM Camp: The Steady Leading "Established Players"

1. Samsung Display (SDC): Clear First-Mover Advantage

2. BOE Technology Group (BOE): Stable Layout of China’s Panel Giant

III. FMM-free Camp: The Innovative Path of "Disruptors"

1. Visionox Technology: Pioneer of ViP Technology

2. TCL Huaxing Optoelectronics: Firm Bet on Ink-Jet Printing

IV. Core Technology Comparison: FMM vs. FMM-free

| Parameter | FMM Technology | Visionox’s ViP Technology | TCL Huaxing’s IJP Technology |

|---|---|---|---|

| Process Principle | Metal mask evaporation | Photolithography pixelation | Ink-jet deposition |

| Pixel Density | 300-600 ppi | 1,700-2,000 ppi | ~326 ppi |

| Aperture Ratio | ~30% | 69% | 50-60% |

| Material Utilization | 30% | High (specific data undisclosed) | 90%+ |

| Equipment Investment | High (100% as benchmark) | Medium-high (~70%) | Low (~57%) |

| Current Yield | Mature (85%+) | Good for small/medium-sized panels | Under development |

| Mass Production Time | Q1-Q2 2026 | Q1 2027 | Q4 2027 |

| Advantages | Mature tech, high yield | High resolution, high brightness, long lifespan | Low cost, high material utilization |

| Challenges | High cost, heavy material waste | Yield improvement for large-sized panels | Material performance, film uniformity |

Source: TrendForce, Omdia, public information from manufacturers

V. Market Prospects and Competitive Dynamics

1. Market Size Forecast

2. Current Competitive Situation

VI. Future Outlook: The Ultimate Showdown of Technology Routes

Short-term (2026-2027): The FMM camp will lead the market with first-mover advantages and Apple’s orders; Samsung’s 8.6-gen line will dominate the high-end IT OLED market

Mid-term (2027-2029): FMM-free technology will gradually mature; Visionox and TCL Huaxing’s 8.6-gen lines will start mass production, and cost advantages will begin to emerge, potentially increasing their market share

Long-term (2030+):

Ultimately, the two technology routes may form a differentiated coexistence pattern: FMM focusing on the high-end, high-yield market; FMM-free covering the mid-to-high-end and large-sized panel markets with its cost advantages

Note: The above analysis is based on the latest public information as of October 2025; uncertainties remain in technological development and market dynamics.

Gestant Display Technology Co.,Ltd. could provide a series of LCD,OLED and PCBA products, such as AMOLED Screen, PMOLED Screen, Round Display Screen, Flexible Display Screen, TFT LCD, Mono-LCD and Bar Display Screen. Customize PCBA/LCD/OLED/FPC/Backlight/Coverlens/TP solutions.

Gestant Display Technology Co.,LTD was founded in 2012 in Shenzhen China. Even, the founder of the company, has more than 15 years of rich experience in LCD display industry. He has been engaging in the basic research of LCD display technology in Japan since his graduate school and has been working in the flat panel display industry after graduation.

Proficient in the manufacturing process and technology development of LCD / OLED / polarizer, Even was also one of the members of China liquid crystal Association who has a senior industry background and supply chain resources. In the past three years, he assisted his shareholders in building factories, purchasing equipment,establishing production lines, and successfully obtaining ISO9001 and ISO14001 system certificates.

He has established good business relations with major panel manufacturers in China (BOE /Tianma / IVO /EDO / Visionox), and the glass supply is stable and sufficient.

Gestant Display's products are widely used in Smart wear,Smart home,Outdoor photography,IP phones, Medical care, Industrial control equipment, Automotive and Vehicle displays, Instrumentation, and other Information terminal applications which could offer long-term after-sale services(such as 2 years quality warranty, long-term supply) .