The Micro LED has long been highly anticipated, but there is no timetable for its mass production.

However, recent news that Apple may break through the Micro LED technology difficulties in the next year or two. Apple will ship its first Micro LED screen on the Apple Watch Ultra as early as late 2024, according to Bloomberg's Mark Gurman.

Osram also revealed in its recent Q4 2022 earnings call that Osram will report Micro LED revenues in 2025 and that it is leading in Micro LED technology. It is known that Apple commercial MicroLED screen supplier is Osram.

Industry analyst Omdia also revealed that in the Apple Watch Ultra2 series, an Apple Watch with a Micro LED display panel will be launched in 2024, featuring the following features: 2.13-inch, 325PPI, RGB Micro LED, flip chip, pixel pitch 80µm, over 900,000 Micro LED chips, stacked hybrid Micro LED pixel structure, LTPO backplane, and electrostatic transfer process.

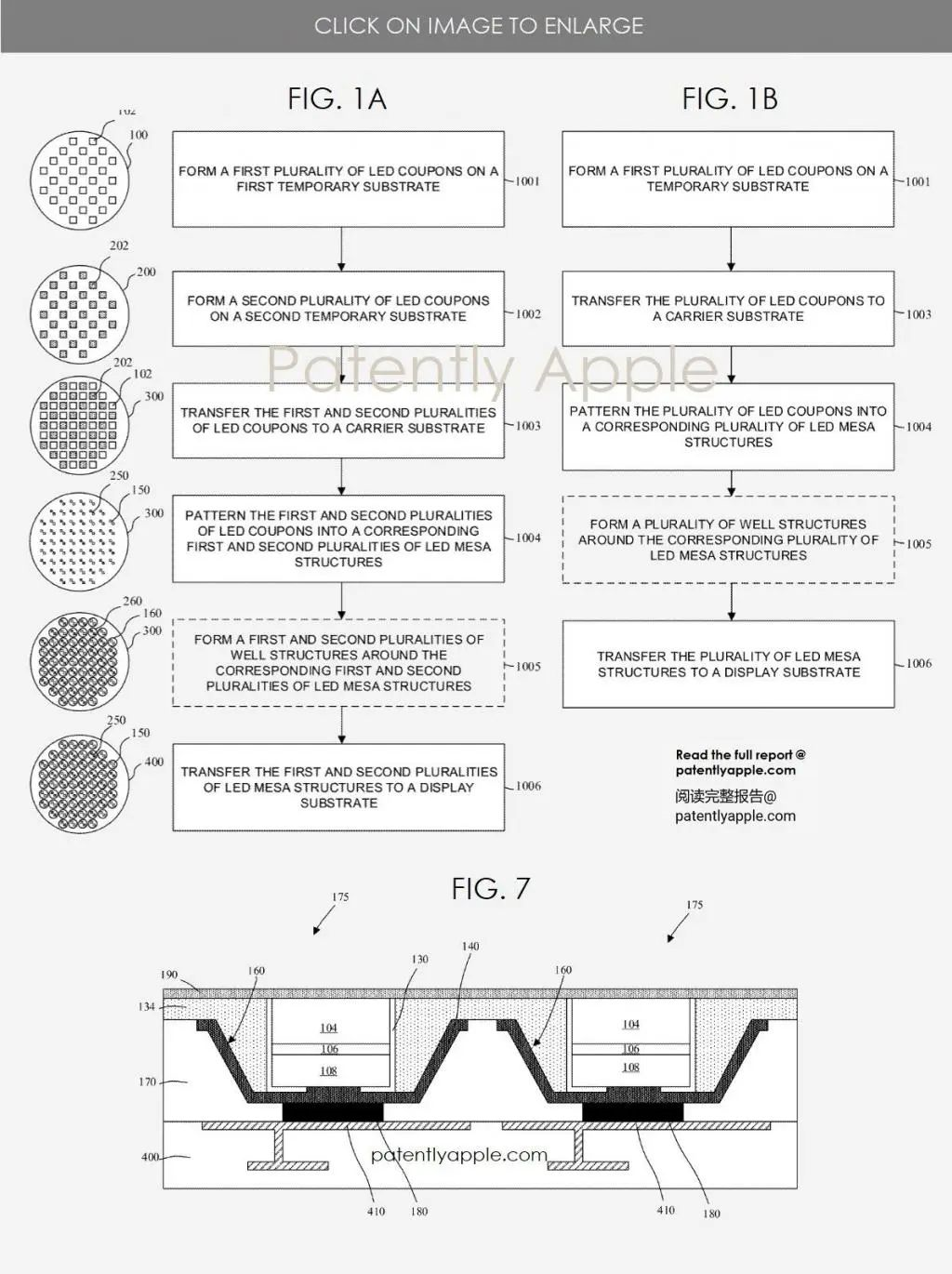

It's worth noting that on January 20, according to a patent list published by the US Trademark and Patent Office (USPTO), Apple was granted a very technical patent for a Micro LED screen, which deals with how to efficiently mass-produce Micro LED screens. Although Apple's patent focuses on the realization of the technology, it is still a long way from actual commercial production, but it will undoubtedly accelerate the process of mass production of Micro LED technology.

Commercial difficulties of Micro LED

From the point of view of the technology itself, MicroLED is currently the best display technology, none of it. Due to the characteristics of small size, high integration and self-lighting of Micro LED chip, it has greater advantages in brightness, resolution, contrast, energy consumption, service life, response speed and thermal stability compared with LCD and OLED in display. It can be said that it is an all-round leader in almost all key indicators. From the perspective of application scenarios, MicroLED can be applied in many fields from flat panel display to AR/VR/MR, spatial display, flexible transparent display, wearable/implantable photoelectric devices, optical communication/optical interconnection, medical detection, intelligent car lights and so on. Micro LED is also the best choice for display hardware, especially for the current hot concept of the metaverse.

However, despite the incomparable advantages of MicroLED technology, its mass production still faces many technical challenges, such as chip manufacturing, mass transfer, detection and repair. This is also the fundamental reason why MicroLED shipments are low and prices are high. To make a full-color 1920*1080 display with fewer than 5 pixels of bad spots, for example, the yield must be 99.9999%!

However, according to Apple's recently published patent, it describes luminous structures and various methods of forming them. These technology implementation cases are expected to bring many benefits to the mass production of Micro LED screens.

In one implementation case, the method of forming a luminaire structure consisted of forming one or more LED test sheets on one or more corresponding temporary substrates and transferring them to the carrier substrate to form LED mesa structures and to the display substrate.

In some implementation cases, well structures can also be formed around the LED mesa structure prior to transfer to the display substrate. Alternatively, a hybrid joint can be used to bond to the display substrate. Processing sequences according to embodiments can be used to form monochromatic and panchromatic displays.

Figure 1 Apple Micro LED patent

In another implementation, the luminous structure includes an LED electrode pad bonded to a substrate such as a complementary metal oxide semiconductor (CMOS). The LED electrode pad can contact a p-n diode based on an inorganic semiconductor and a metal bottom contact bonded to the electrode pad.

As for the mass production of Apple's Micro LED technology, Korean media quoted experts as saying, "There is no need to worry too much about Apple's self-developed screen, because the cost of Micro LED screens is too high, and mass production is impossible in the short term."

Apple Micro LED supply chain forecast

Apple launched the Apple Watch in 2014 and will celebrate its 10th anniversary next year, according to Omdia's public information. The Apple Watch has plans to break into the top end of the sports and professional outdoor watch market. Against this backdrop, Apple is working on a new high-end model called the Apple Watch Ultra 2, which will feature ultra-bright and high-contrast Micro LED display panels, as well as ruggedizer, water and dust resistance, and earthquake resistance.

Omdia estimates that the Apple Watch Micro LED display panel will have the following features:

·2.13 inches

· The resolution is 540X440, which means the number of Micro LED chips will be 540x440x3 (RGB sub-pixels) x1.2 (for redundant RGB chips) = 900,000 chips

·Micro LED chip size is 10µm; The Micro LED display panel has 80µm pixel pitch

· Flip Micro LED chip and photoelectric detection LED

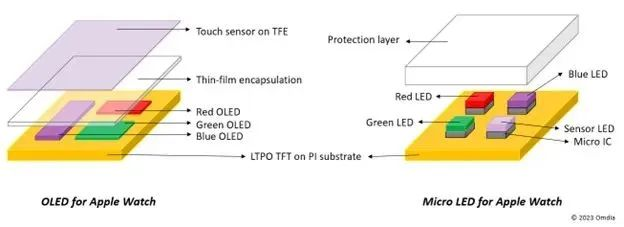

· Stack mixed Micro LED pixels and sub-pixel structures, as shown in Figure 2

·LTPO TFT backplane

· Electrostatic mass transfer (from LED epitaxial wafer to LTPO backplane)

Figure 2 Apple's innovative Micro LED display panel structure compared with traditional OLED Source: Omdia

Meanwhile, Omdia estimates the Apple Watch Micro LED supply chain:

· Major Micro LED equipment (such as transfer and critical optical test and repair machines) will be licensed by Apple

·LTPO TFT backplanes will use glass substrates manufactured by LG Display, which will allocate backplane capacity from its AP3-E5 Gen6 TFT and flexible OLED production lines. Approximately 5,000-10,000 Gen 6 substrate capacity per month can be arranged for the production of Micro LED display panels. Each Gen 6 substrate can be embedded with more than 1,000 2.x inch display panels

·Ams OSRAM is a supplier of Micro LED epitaxial wafers used to produce chips

·LuxVue and Apple Taiwan R&D Center are responsible for Micro LED chip segmentation and electrostatic mass transfer

· Apple is also working on an alternative Micro LED display panel based on massive transfer and CMOS wafers, which involves a collaboration with Taiwan Semiconductor

· Micro-assembly is completed by Taiwan Institute of Industrial Research

· The final assembly of the Micro LED display panel module will be completed by LG Display Korea

· Final Apple Watch assembly will be done at Foxconn and Lishun Precision factories in Vietnam.

Apple's Product Ecosystem Comes with its Own Micro LED 'Test Field'

Given the number of Micro LED chips in use (more than 900,000 LED chips) and the complex process of the LTPO backplane, the cost of a Micro LED display panel will certainly be higher than the current flexible OLED. However, the advantages of a Micro LED display panel for the Apple Watch will be high brightness, outdoor readability, rugged durability for professional outdoor use, and an ultra-thin display shape that provides more room for the battery.

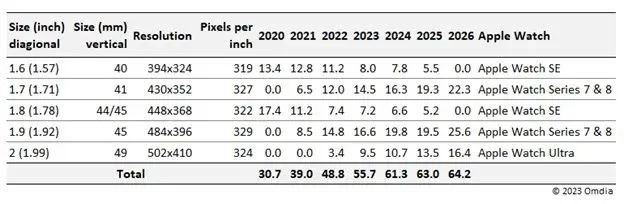

Omdia estimates that the 2.13/2.2-inch Micro LED with 556x452 resolution will be mass-produced in 2024 for $115, with touch and cover glass added at an additional cost of $10. A Micro LED display panel will cost three times as much compared to the average price of a 2.0-inch flexible OLED ($38-40) (see Figure 3). The major cost factors are not only Micro LED chips, but also LTPO backplanes, mass transfer, modulation, driver ics, test and repair, and final assembly.

Figure 3: OLED vs. Micro LED cost comparison Source: Omdia

The high cost of the Micro LED display panel will push the price of the Apple Watch Ultra series above $1,200 - just like the current Apple Watch Hermes. The Apple Watch Hermes is priced at $1,759 in the luxury segment, while the Apple Watch Series 8 is priced at $399.

Omdia also said that Apple has been purchasing 40-50 million flexible OLeds per year. Shipments of flexible OLED smartwatch displays continue to climb as Apple Watch continues to be popular with users in the terminal market. Omdia expects that each series will have a different purchase volume and the current situation is as follows:

·Apple Watch SE Series (1.6 "and 1.8") : 18 to 20 million pieces per year. Apple plans to gradually reduce its focus on this segment in favor of larger sizes

·Apple Watch 7 Series (1.7-inch and 1.9-inch) : 25 to 26 million pieces per year. Apple plans to expand the segment to more than 50 million tablets a year, including the larger SE series

·Apple Watch Ultra Series (2.0 inches) : Now 3 to 4 million pieces per year. Apple plans to expand this segment with a new MicroLED display panel, as well as a larger X Series

Omdia expects Apple Watch Micro LED panel purchases to reach 3 million to 4 million units per year in the first two years (2024-25) (see Figure 4) and grow to 10 million units per year in the long term (2028-2029). According to Omdia, Apple is setting up three Micro LED display panel module production lines; The first production line will be ready in 2023. These production lines will be subdivided based on Micro LED and display panel processes. This is one of the reasons why Apple will handle the Micro LED process itself by setting up a production line at LG Display's factory.

Figure 4: Apple Smartwatch Display Panel Forecast (million pieces)

One problem worth the attention of panel manufacturers is that Apple has a strong product ecosystem, from small-screen Apple Watch to iphones of different sizes to iPad, MacBook iMac, and Apple TV. Each product sells millions, tens of millions, and even hundreds of millions of iphones every year.

This also represents that Apple has the ability to realize rapid technological realization with its rich product line, even starting from the smartwatch product, it also has a great technological realization ability. If Apple uses Micro LED technology to expand the adoption of its product ecosystem, especially when it matures for the iPhone, it will certainly cause a big shock in the display industry.

Apple's entry into the Micro LED industry chain impact

It has to be said that every technological innovation and application of Apple has a strong demonstration effect on technology and has a strong appeal to capital and supply chain. In fact, in addition to Apple, Huawei, Samsung, Google, SONY, LG, TCL, BOE, SAN 'an Optoelectronics, Liade and other domestic and foreign manufacturers have all laid out Micro LED in recent years.

In 2020, Meta entered into a partnership with Plessey, a Micro LED display manufacturer that Apple was interested in acquiring, to jointly develop Micro LED technology. In January 2022, Snap acquired Compound Photonics, a Us-Based supplier of Micro LED/LCOS solutions. In May 2022, Google acquired Raxium, a startup that develops Micro LED display technology for VR and AR devices. Google is expected to officially enter the market for Micro LED-based VR/AR devices. Samsung Display is also reportedly developing Micro leds for VR and AR devices.

In January 2023, an industry source revealed that Samsung Display has also started a Micro LED development project for smartwatches, with the Micro Display team in charge. Notably, Samsung Display has set a goal for the actual commercialization, rather than the research and development phase to ensure the safety of the technology. Although Samsung has previously launched The Wall series of Micro LED TVS, the series cost millions of yuan and is not yet commercially available. The introduction of the Micro LED as the next generation product and the smartwatch as the first application seems to indicate that Samsung Display has also found a relatively good solution, especially for the production cost and manufacturing challenges of Micro LED.

At present, Chinese display industry enterprises are also continuing to optimize Micro LED technology and reduce production costs. As early as 2020, TCL CSOT established Core Display Technology in a joint venture with SAN 'an Optoelectronics Co., LTD., which has the largest LED chip shipment in China in recent years, to develop Micro LED technology. The Micro LED production base set up by Liard and Crystal Photonics has been officially put into mass production in 2020.

In November 2022, BOE subscribed no more than 2.1 billion yuan for the A-shares issued by Huacan Optoelectronics, becoming its largest shareholder, and will increase the investment in Micro LED wafer manufacturing and packaging and testing. In the "most critical link" of massive transfer technology, Liard, Shenkang Jia also achieved a breakthrough, transfer yield has increased to 99.9%. Recently, Apple supplier AU revealed that it has started to develop new technologies and products, including Micro LED, and expects to mass-produce wearable devices equipped with Micro LED in the second half of 2023, measuring more than 2 inches.

Production lines are expected to be further expanded in 2023. Visionox previously announced that the Micro LED production line will also be mass-produced in Chengdu; Shentianma also said it will build a full process Micro LED test line from large volume transfer to display module.

In addition, the Micro LED materials, components, equipment ecosystem has been further consolidated, display panels, LED chips, mass production of enterprise equipment, driver chips and other links have also formed a good collaboration. For example, Forcy and Play Nitride decided to work together to build a 6-inch Micro LED production line. All these will provide a good industrial chain innovation and supporting basis for the mass production of Micro LED technology.

From the perspective of the application side, we can also expect that with the continuous implementation of the concept of the meta-universe, the market demand for VR/AR devices and various wearable devices will rise rapidly, which will drive up the demand for Micro LED, such as smart glasses. Compared with traditional LCD, OLED, or even silicon-based OLED, Micro LED has superior characteristics such as ultra-high PPI, fast response, and ultra-high brightness, making "Micro LED+ optical waveguide solution" the best choice for smart glasses applications. Micro LED applications are also expected to emerge in the smartphone, automotive and transparent display markets in the next few years.

summarize

For Apple, MicroLED technology, which has been around for nearly a decade, needs to come to frum at the right time, and the MicroLED screen on the Apple Watch Ultra, which will be available in 2024, is the beginning of its ecological layout. It's bound to make its way to iphones, ipads and other devices in the future. Today, the era of MicroLED technology has begun.

Gestant Display Technology Co.,Ltd. could provide a series of LCD and OLED products, such as AMOLED Screen, PMOLED Screen, Round Display Screen, Flexible Display Screen, TFT LCD, Mono-LCD and Bar Display Screen. Customize PCBA/LCD/OLED/FPC/Backlight/Coverlens/TP solutions.

Gestant Display Technology Co.,LTD was founded in 2012 in Shenzhen China. Even, the founder of the company, has more than 15 years of rich experience in LCD display industry. He has been engaging in the basic research of LCD display technology in Japan since his graduate school and has been working in the flat panel display industry after graduation.

Proficient in the manufacturing process and technology development of LCD / OLED / polarizer, Even was also one of the members of China liquid crystal Association who has a senior industry background and supply chain resources. In the past three years, he assisted his shareholders in building factories, purchasing equipment,establishing production lines, and successfully obtaining ISO9001 and ISO14001 system certificates.

He has established good business relations with major panel manufacturers in China (BOE /Tianma / IVO /EDO / Visionox), and the glass supply is stable and sufficient.

Gestant Display's products are widely used in Smart wear,Smart home,Outdoor photography,IP phones, Medical care, Industrial control equipment, Automotive and Vehicle displays, Instrumentation, and other Information terminal applications which could offer long-term after-sale services(such as 2 years quality warranty, long-term supply) .