While the demand of South Korea's display industry has slowed down due to the economic downturn and the rise of China, the study shows that expanding the next-generation OLED market is the key breakthrough for South Korea's display industry to maintain competitiveness. Improving the price competitiveness of OLED and expanding the application field are regarded as an important task of the Korean display industry at present. Therefore, Samsung Display announced that its goal is to use OLED panels for all IT devices.

On February 21, the Korea Industrial Technology Evaluation Institute (KEIT) and the Korea Display Industry Association held the "2023 Display Technology Roadmap Presentation Conference" at the South Korean Commercial and Industrial Conference in Seoul's central region. Seong-chan Cho, vice president of Samsung Display, Yeo Jun-ho (executive director), head of LGDisplay Group, and KEIT PD Park Young-ho attended the speech.

They agreed that the main displays used in the world should quickly shift from LCD to OLED to get rid of China's catch-up. Thanks to the strong support of the government, the scale of China's OLED market is expanding. Although South Korea ranks first in the world at present, China's OLED market is growing faster and faster. It is reported that South Korea leads China in the technology of large-scale OLED for TV for 4-6 years, but the gap between China and South Korea in the technology of small and medium-sized OLED for smart phones and laptops is only 2 years or less.

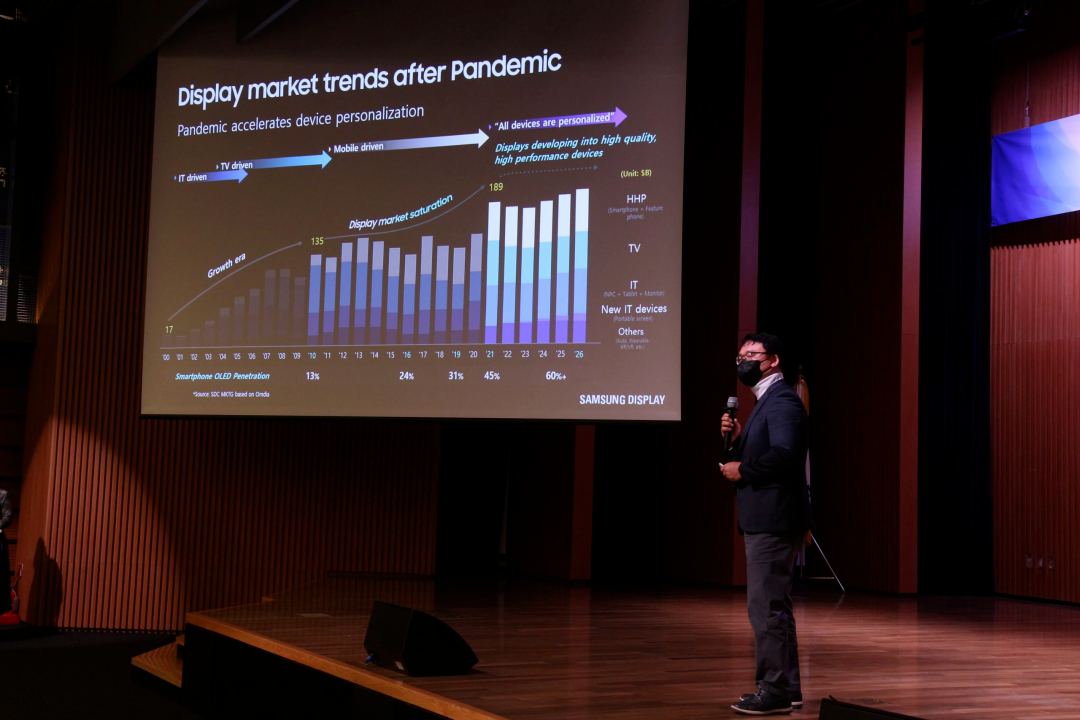

What's worse, the display panel industry is deteriorating due to the sharp decline in demand for household appliances and IT equipment after COVID-19. Panel exports have declined for eight consecutive months since June last year. The scale of the global display equipment market, as an investment indicator, also decreased significantly from the previous year.

For the adverse business environment, Seong-chan Cho, vice president of Samsung Display, stressed the sense of crisis and chose OLED as the future IT business. Seong-chan Cho, vice president, said, "In the display market, we are behind in price competitiveness".

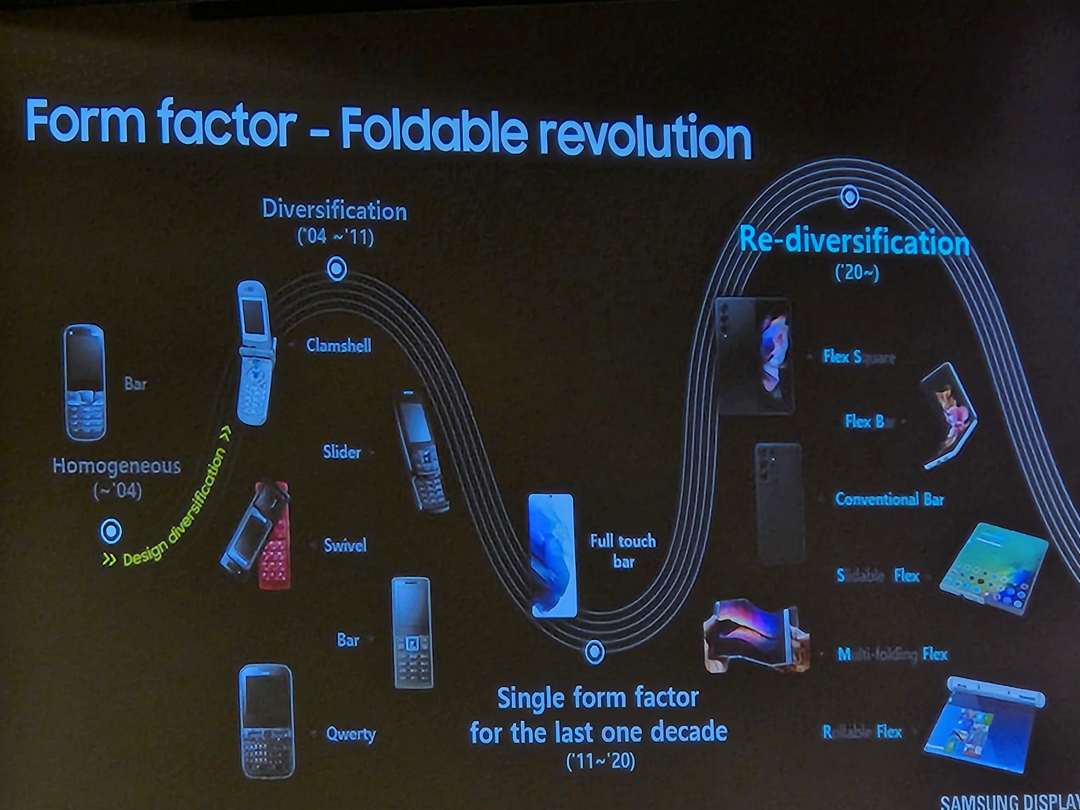

He continued to say: "With the emergence of COVID-19, the market has changed. Monitors are scattered in every space of the house, and now it has become a ubiquitous situation. The company is considering many measures to deal with personalized mobility. He said that some people judged that the future of display lies in the" personalization "of IT devices such as smart phones, tablets, VR/AR.

Seong-chan Cho said: "The company still believes that IT monitors have more advantages than high-end televisions in terms of price and area. Our goal is to change all of them to use OLED panels."

Yeo Joon-ho, head of LG Display Group, stressed the possibility of expanding the market through LG Display's transparent OLED, which was first developed and successfully mass produced in the world. Group Leader Yeo said: "Transparent display is a technology that maximizes the advantages of OLED. It emits light in pixels and can be used in advertising, mobile and other fields. After the existing 55 inches, the company will release a 70 inch product at the end of this year."

Korean experts suggested that Korean enterprises should increase the market share of OLED based on super gap technology to compete with Chinese enterprises. Kang Min-soo, head of Omdia, a market research company, said, "OLED has the characteristic of reducing power efficiency with the increase of area, so it is necessary to accelerate the development of additional technologies applicable to each device."

Gestant Display Technology Co.,Ltd. could provide a series of LCD and OLED products, such as AMOLED Screen, PMOLED Screen, Round Display Screen, Flexible Display Screen, TFT LCD, Mono-LCD and Bar Display Screen. Customize PCBA/LCD/OLED/FPC/Backlight/Coverlens/TP solutions.